Services

Our 5 Value Pillars

Listing the Unlisted (Whisper List)

anonymous off- market listings; introductions only after vetting, NDA, and brokerage agreement

Joint Venture Partnering & Structuring

identify, qualify, and align JV partners; support governance, terms, and execution

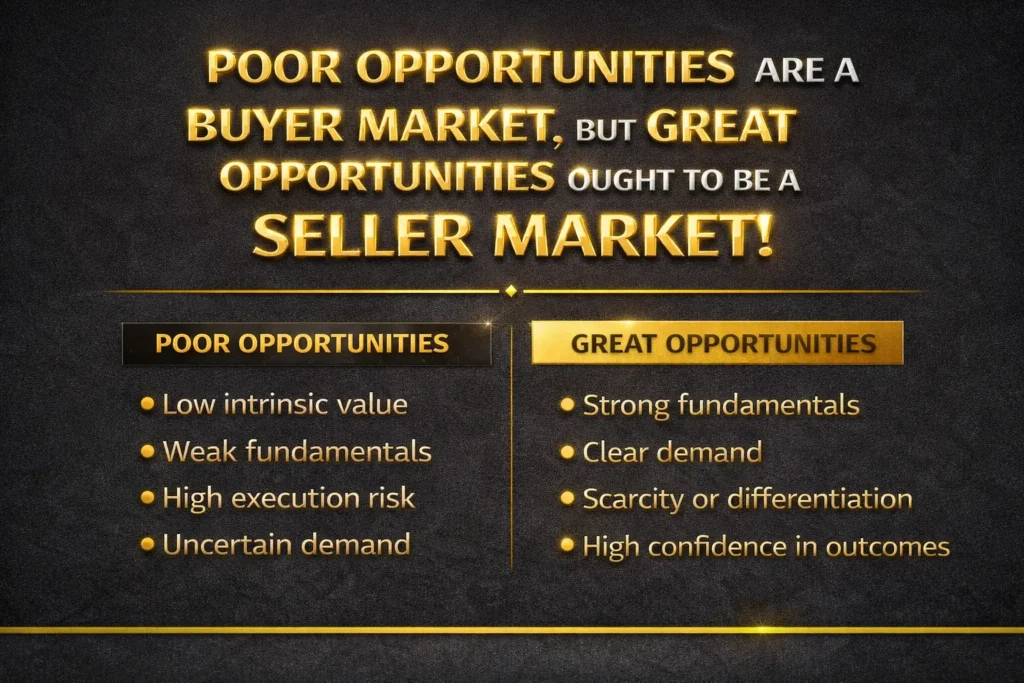

Market Expansion Opportunities

market entry support, representation, and go-to-market execution

Logistics & Residency Assistance

relocation, setup coordination, and local practical support

Maxloyal Business Development — Services

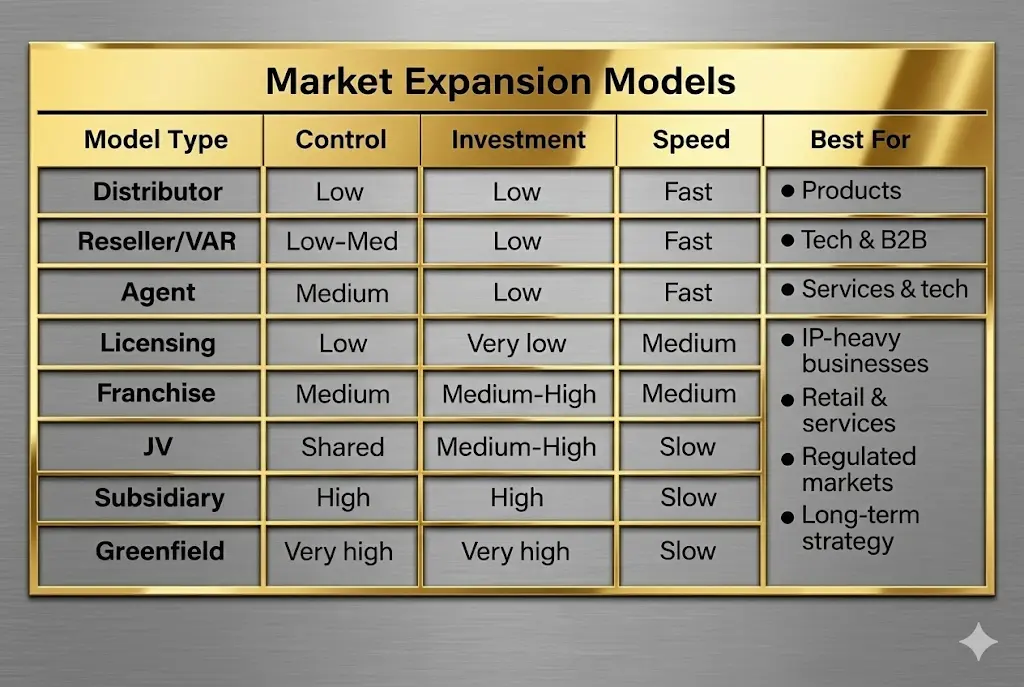

Small Business Expansion & Market Development

Market Expansion Models

Sample of Small Business Targets