Agentic AI is changing what “work” means. As autonomous tools move from assisting humans to executing full workflows, two trends are accelerating at the same time:

- Enterprises are getting leaner—automating routine work, compressing layers, and re-allocating budgets toward technology.

- Individuals and small teams are getting stronger—using AI to perform functions that previously required departments.

The result is a new reality: traditional employment feels less stable, while self-employment—done smartly—can become a durable path.

But there’s a catch. AI doesn’t automatically create a business. It creates capability. Turning capability into revenue requires market logic, readiness, and a clear go-to-market path. That’s where Maxloyal fits.

The Enterprise Exodus: Why “big jobs” are shrinking

Across many industries, companies are pursuing an operating model built on automation, outsourcing, and AI augmentation. The direction is clear: fewer people doing more “orchestrating,” while machines handle increasing portions of execution.

What this means for professionals and founders:

- Job descriptions become moving targets (roles change faster than retraining cycles).

- Middle layers get pressured (coordination work is increasingly automated).

- Risk shifts to the individual (you may need a “Plan B” that you control).

Where Maxloyal creates clarity:

If you’re considering a move from employee to founder—or scaling a side venture—your first risk is not “competition.” It’s uncertainty: Is this the right time? Is my offer strong enough? Can I actually expand?

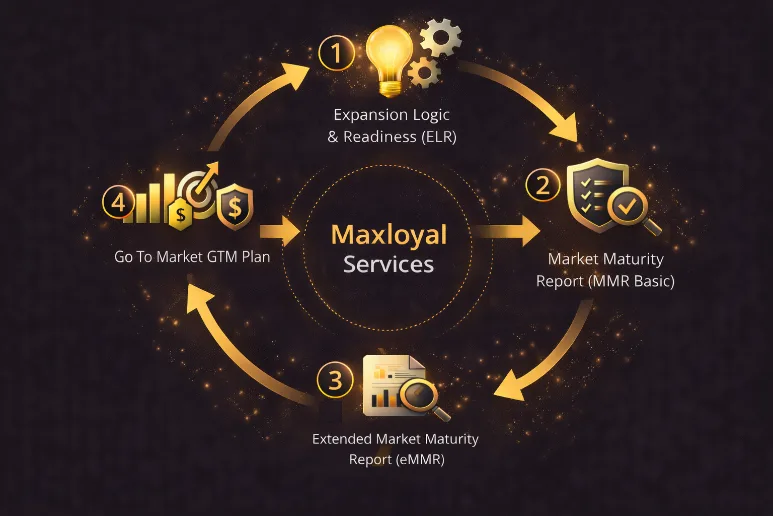

➡️ Maxloyal Free Offer: Expansion Logic & Readiness (ELR)

ELR helps you answer the founder’s core questions quickly:

- What exactly is my value proposition (in a market-ready way)?

- What assumptions must be true for growth to work?

- Where are my biggest readiness gaps (delivery, pricing, positioning, credibility, capacity)?

- What is the lowest-risk path to validate expansion?

The Solopreneur’s Edge: Why small is the new big

AI gives founders leverage: customer support, marketing drafts, content, product iterations, research synthesis, basic automation, analytics—many of these can be done faster and cheaper with the right tool stack.

That enables:

- Lower overhead (fewer hires required early on)

- Faster iteration (test–learn–adjust cycles)

- Higher resilience (you can pivot without carrying a large payroll)

But leverage without direction can become chaos. Many AI-enabled founders build “busy businesses” that don’t scale because they skipped a critical step: choosing the right market and entry strategy.

Where Maxloyal creates traction:

After ELR confirms you have a viable expansion thesis, the next question is:

Which market is most ready for your offer—and how do you enter without burning cash?

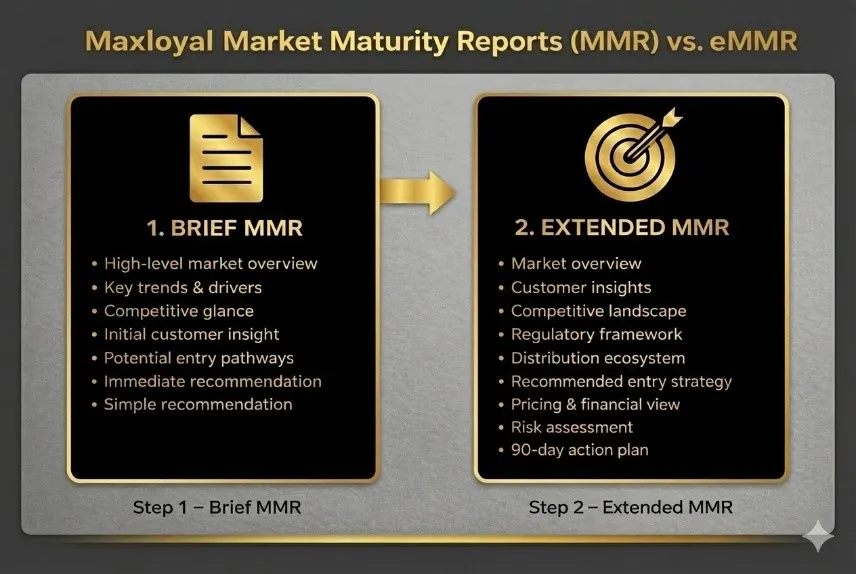

➡️ Maxloyal Market Maturity Review (MMR)

MMR is your decision-grade map of where to expand first:

- Market attractiveness and timing

- Buyer readiness and adoption conditions

- Channel reality (how you actually reach customers)

- Competitive intensity and differentiation gaps

- Execution risk and “what must be true” milestones

➡️ Extended MMR (eMMR) (for higher-stakes bets)

When you need deeper validation: adjacent segments, regulatory exposure, pricing benchmarks, partner strategy, and scenario risks.

Obstacles vs. solutions: it’s your choice

In the AI era, the real divide isn’t “tech vs non-tech.” It’s reactive vs deliberate. Founders who stay stuck in obstacles tend to say:

- “I don’t have time.”

- “Marketing is expensive.”

- “I’m not ready operationally.”

- “Quality will drop if I grow.”

Those are real concerns—but they’re also solvable when you use a structured approach.

Where Maxloyal reduces risk:

Maxloyal doesn’t sell hype. We build logic:

- A clear offer (value proposition + packaging)

- A realistic expansion path (sequence of markets/segments)

- A controlled validation plan (what to test, how to measure)

- A practical roadmap (what to fix first)

Advice for job security in the AI era: “Hire yourself”—but do it intelligently

If you want long-term resilience, consider building an asset you control: a venture, a micro-business, or a specialized service.

The smartest “hire yourself” move looks like this:

- Clarify what you sell and why it wins

- Validate expansion logic before scaling

- Pick the market with the highest readiness

- Execute a focused go-to-market plan

➡️ Maxloyal Go-To-Market (GTM) Plan

When you’re ready to move from analysis to execution:

- ICP (ideal customer profile) + positioning

- Offer and pricing structure

- Channel strategy and partner approach

- Pipeline-building plan (outreach, content, referrals)

- 90-day rollout plan with measurable milestones

In summary

- Agentic AI will reshape employment and compress many traditional roles.

- Entrepreneurship becomes more accessible—but only for founders who build market clarity.

- The safest strategy isn’t just “use AI.” It’s use AI + a smart expansion plan.

- The best next step is to reassess now—before opportunity becomes regret.

Call to action

Thinking about expansion—or starting your own venture in the AI era?

Start with Maxloyal’s Free Expansion Logic & Readiness (ELR). In one structured step, you’ll know whether your expansion idea is sound—and what to do next.

Next step: ELR (Free) → MMR (Market selection & readiness) → GTM Plan (Execution)

By: Sam Ahlin