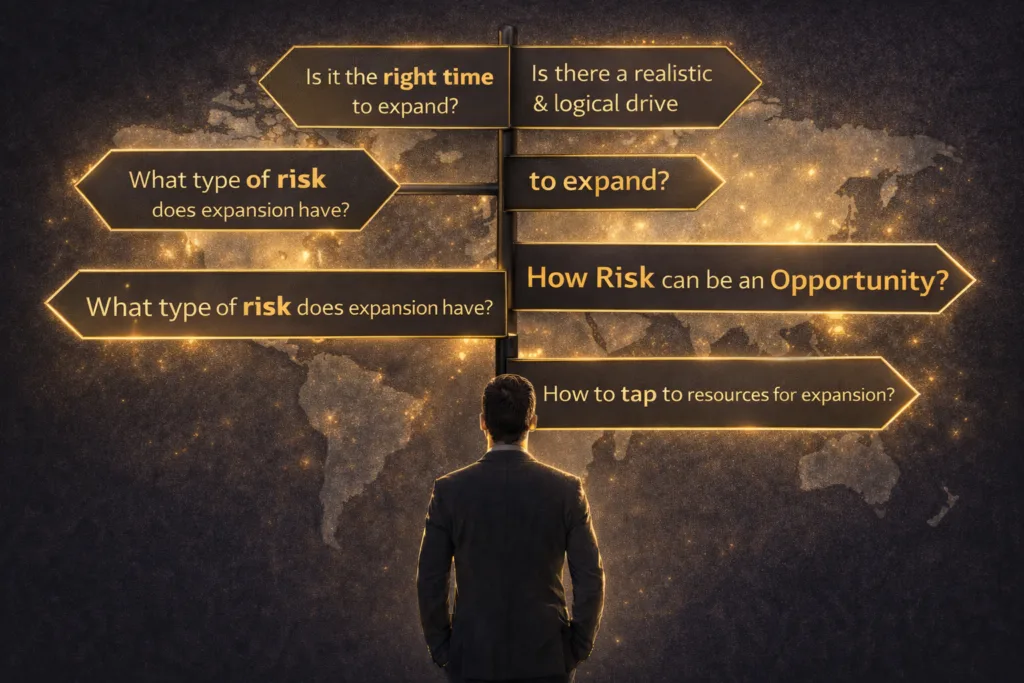

Is It an Opportunity or a Risk?

For family-owned enterprises, international expansion is rarely a purely commercial decision. It is often intertwined with legacy, control, family dynamics, and long-term stewardship. Unlike venture-backed startups, family businesses typically prioritise continuity, independence, and measured growth—which makes the expansion question both more sensitive and more consequential.

Expansion, therefore, is neither automatically an opportunity nor inherently a risk. For family enterprises, it becomes one or the other depending on timing, logic, governance, and risk design.

1. Is It the Right Time to Expand—for the Family, Not Just the Business?

In family businesses, timing is as much about people as it is about performance. Research and advisory insights from institutions such as Harvard Business Review and McKinsey consistently show that expansion failures often stem from internal readiness issues—particularly around leadership bandwidth and decision clarity.

Signals that timing may be right include:

- Stable or improving profitability and cash flow

- Clear decision authority within the family

- Alignment between generations on growth ambition

- Management capacity beyond daily operations

Expansion becomes risky when it is driven by fear of stagnation, external pressure, or succession uncertainty rather than a deliberate strategic choice.

2. Is There a Realistic & Logical Reason to Expand?

Family enterprises tend to succeed internationally when expansion is logic-driven, not ego-driven.

A sound expansion logic answers:

- Why this market—now?

- What part of our value proposition truly travels?

- What advantage do we have that local competitors do not?

Advisors frequently distinguish between “push” expansion (escaping domestic pressure) and “pull” expansion (responding to genuine demand). Family businesses that expand successfully are almost always responding to pull, not push.

3. What Type of Risk Does Expansion Create for a Family Business?

For family-owned firms, expansion introduces unique risk layers beyond financial exposure:

- Control risk – diluted decision-making or external influence

- Governance risk – unclear roles between family and non-family managers

- Reputational risk – brand and family name exposure in unfamiliar markets

- Execution risk – overreliance on a small leadership group

- Capital risk – tying family wealth to uncertain outcomes

These risks are not reasons to avoid expansion—but they must be recognised and designed around.

4. When Risk Becomes an Opportunity

In disciplined family enterprises, risk becomes an opportunity when expansion is structured to protect the core business.

This often means:

- Partner-led or representative entry models

- Staged commitments rather than “all-in” investments

- Retaining strategic control at family level

- Treating early expansion as learning, not conquest

Experienced consultants observe that family businesses outperform peers when they expand patiently, valuing resilience over speed.

5. What If the Family Decides to Do Nothing?

Not expanding is also a strategic choice—and sometimes the correct one. Remaining domestic can preserve focus and control, especially when the home market remains attractive.

However, doing nothing also carries risk:

- Overdependence on one market or regulatory system

- Increased exposure to local economic cycles

- Reduced long-term optionality for the next generation

The real risk is not waiting—but waiting without clarity or intent.

6. How Can Family Businesses Access Expansion Resources Without Losing Control?

Contrary to common belief, expansion does not always require family capital.

Many family enterprises expand through:

- Strategic partners or distributors

- Investor-funded, market-specific expansion vehicles

- Joint ventures with clear governance boundaries

- Advisory-led validation before capital commitment

Increasingly, investors are willing to fund expansion initiatives, not ownership dilution—provided the logic and risk profile are well defined.

7. Can a Family Business Explore Expansion Without Taking Big Risks?

Yes—if exploration is separated from execution.

Best practice for family enterprises involves:

- Testing internal readiness before testing markets

- Validating demand and regulation without committing assets

- Designing exit options before entry

- Preserving family control throughout early stages

This staged, logic-first approach allows families to explore opportunity while protecting legacy.

Closing Reflection

For family-owned enterprises, international expansion is not a race—it is a stewardship decision.

The most successful family expansions are grounded in clarity, patience, and governance discipline, ensuring growth strengthens the business without compromising what the family has built over generations.

The real question is not “Can we expand?”

It is “Can we expand without putting the family, the business, or the legacy at unnecessary risk?”

Call to Action – A Disciplined First Step

Before markets, capital, or partners, Maxloyal encourages family businesses to start with Expansion Logic & Readiness (ELR)—a confidential, founder-level assessment to determine whether expansion makes sense now.

For ELR-approved companies, we recommend a Basic Market Maturity Review (MMR) at no cost to validate early market signals before deeper commitment.

Clarity first. Markets second. Capital last.

By: Sam Ahlin